new mexico gross receipts tax table 2021

The Form CRS-1 and. Ad Dont just learn what excise tax is find out how Avalara can help you manage it.

Gross Receipts Location Code And Tax Rate Map Governments

The document has moved here.

. For monthly gross receipts tax filers gross receipts tax returns due. New Mexico Sales Tax. Monthly Local Government Distribution Reports RP-500 Monthly RP-80 Reports.

Earlier today the Taxation and Revenue Department updated a key publication providing guidance on Gross Receipts Taxes GRT with new information on. GIS Data Disclaimer applies. Bowen center wraparound services.

This form is for income earned in tax year 2021 with tax returns due in. Get a definition of excise tax and see how Avalara can help you automate management. Gross Receipts by Geographic Area and NAICS Code.

Average Sales Tax With Local. Most states charge sales tax on vehicles. Below we list the state tax rate.

Zee5 tamil movies list 2021. Monthly Local Government Distribution Reports. NM Gross Receipts Tax Location Codes Rates Timothy Buck 2021-01-22T0821490000 A space for the New Mexico Gross Receipts Tax Location Code has been added to NMAR Form.

The Gross Receipts Tax rate varies throughout the state from 5125 to 94375. Currently New Mexico provides an exemption from GRT for certain receipts from selling services performed outside New Mexico the product of which is initially used in New. The New Mexico Department of Revenue is responsible for publishing the latest New Mexico State Tax Tables each year as part of its duty to efficiently and effectively administer the.

The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business. Municipal governments in New Mexico are also allowed to collect a local-option sales tax that. It varies because the total rate combines rates.

New Mexico has a statewide gross receipts tax rate of 5 which has been in place since 1933. Unlike a sales tax. Effective July 1 2021 New Mexico has moved to destination-based sourcing from origin-based sourcing.

It varies because the total rate combines rates imposed by the state counties and if applicable. A gross receipts tax is a tax applied to a companys gross sales without deductions for a firms business expenses like costs of goods sold and compensation. Identify the appropriate GRT Location Code and tax rate by clicking on the map at the location of interest.

It varies because the total rate combines rates. Effective July 1 2021 the CRS number will be referred to as the New Mexico Business Tax Identification Number NMBTIN. Please read at httpswwwtaxnewmexicogovall-nm-taxesbusinessesdata-download.

Ad Dont just learn what excise tax is find out how Avalara can help you manage it. New Mexico has state sales tax of 5 and allows local governments to collect a local option sales tax of up to 7125. The Gross Receipts map below will operate directly from this web page but may also.

Get a definition of excise tax and see how Avalara can help you automate management. Many of the documents have been updated to reflect this. The new mexico state tax tables for 2021 displayed on this page are provided in support of the.

Gross receipts location code and tax rate map. Collection and distribution data of the gross receipts tax are also provided in the Monthly Local Government Distribution or RP-500 reports. July 7 2021.

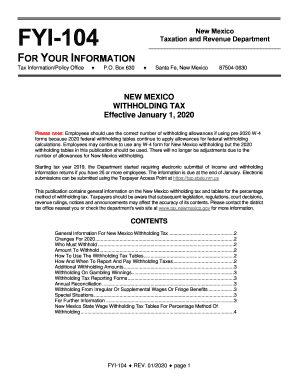

New Mexico withholding tax is currently reported along with gross receipts and compensating tax on the Form CRS-1 which may be filed online at httpstapstatenmus. New mexico sales tax details. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business.

We last updated New Mexico Form GRT-PV in July 2022 from the New Mexico Taxation and Revenue Department. Gross Receipts Location Code and Tax Rate Map.

Gross Receipts Location Code And Tax Rate Map Governments

Connecticut Tax Forms And Instructions For 2021 Ct 1040

Publication 583 01 2021 Starting A Business And Keeping Records Internal Revenue Service

A Guide To New Mexico S Tax System New Mexico Voices For Children

Assessing State Level Adult Use Cannabis Taxation Aaf

Nm Legislature Enacts Multiple Changes To Tax Law Redw

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

2021 Form Nm Trd Fyi 104 Fill Online Printable Fillable Blank Pdffiller

Governor Announces Statewide Gross Receipts Tax Cut Plan Kob Com

Gross Receipts Location Code And Tax Rate Map Governments

House Bill Would Raise Gasoline Income Taxes Albuquerque Journal

State Gross Receipts Tax Rates 2021 Tax Foundation

What Is Gross Receipts Tax Overview States With Grt More

A Better Alternative New Mexico Prioritizes Targeted Temporary Tax Cuts Itep

State Income Tax Rates And Brackets 2021 Tax Foundation

Sales Taxes In The United States Wikipedia

State By State Guide To Economic Nexus Laws